Faculty

Socioeconomic System

IZUMI Kiyoshi

- Position

- Prof.

- Affiliation

- Department of Systems Innovation,Faculty of Engineering,The University of Tokyo

Department of Technology Management for Innovation,The University of Tokyo

Graduate School on Public policy,The University of Tokyo

- Keyword

- Agent-based simulation; Data mining; Artificial market; Text mining; Economic simulation

- izumi(at)sys.t.u-tokyo.ac.jp※Please replace (at) with @ and send mail.

Financial data mining and artificial market simulation

Financial data mining and artificial market simulation

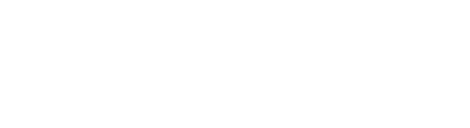

To support financial market analysis, we study new information technologies to extract useful information from economic data and to analyze future market trends. We develop financial data-mining methods to analyze various types of economic data such as news articles and high-frequency order data by machine learning method and to support decision making and risk management of financial trading.

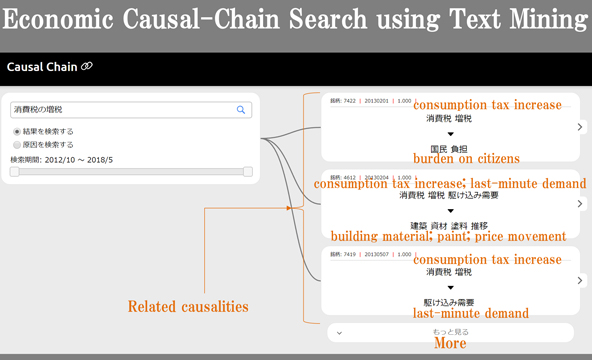

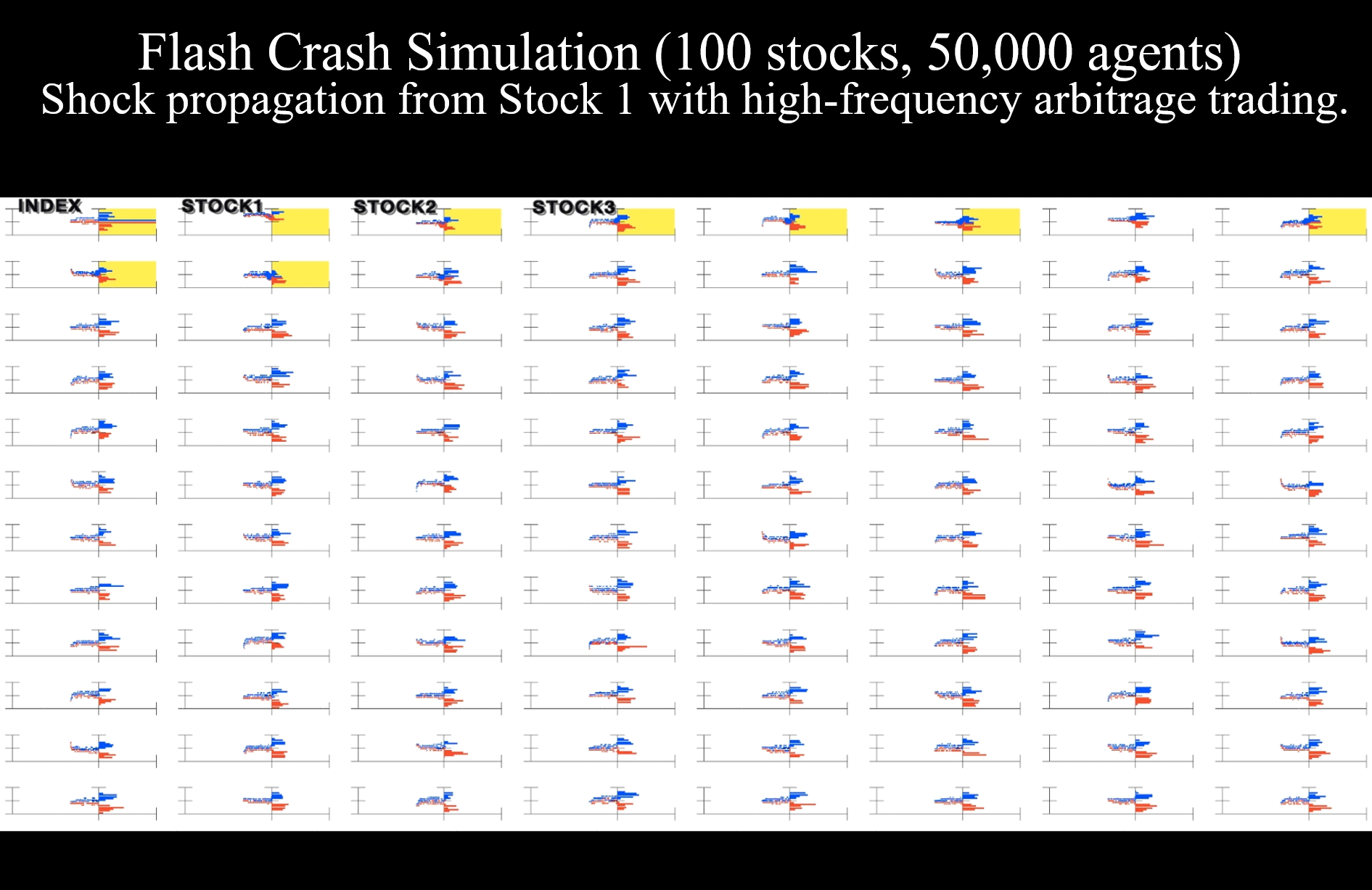

Marketing and web advertisement simulation

An artificial market, an agent-based simulation of financial markets, can be a reliable tool to study market dynamics and to design financial regulations. For example, major stock markets adopted artificial market simulations when they discussed the change in market tick size, the smallest price unit of stock. In collaboration with financial institutions, we study the impact of new financial regulations and trading rules on market stability for more stable and efficient financial markets.

Trajectory mining and human movement simulation

We develop technologies to analyze large data about social behavior such as financial trading data, marketing data, and social media. Besides, we study the modeling of the relationship between microscopic personal behavior and macroscopic social data. We also develop construction methods of a social simulation model to identify the mechanism of social phenomena caused by the interaction between individual behavior. Then, we apply the simulation model to support social activities in the real world.